Your Ultimate Guide to Keeping the Cash Flowing During Your Visit To Ghana

By Karel Mensah

When you’re traveling, especially to a place like Ghana, it’s easy to lose yourself in the experiences. This country has places that will inject happiness into your soul. However, like with everything else in the world, partaking in these experiences isn’t free. Money matters in Ghana. And the general philosophy when it comes to cash among Ghanaians, is to spend less on transactions and fees and to spend more on enjoyment.

This is a Ghanaian guide to spending money in our country. We’ll start off with the online financial platform Wise, and then finally get into the grit of spending money like a Ghanaian, even while you’re visiting.

Although you can simply choose to use a VISA Card or a Mastercard to access your money, it’s good to keep an open mind when it comes to moving your money around for transactions. There are definitely some savings to be had, and some novel experiences to spend on.

Keep the Money for Your Trip in Wise

Let’s start off with Wise, an institution that embodies financial independence. Multi-currency money conversions and transfers feel almost as easy as a game downloaded from the App Store. Wise is authorized by the National Bank of Belgium and allows you to save and transfer money across 50+ currencies. Of course, if you’re thinking about a new place to keep money, it warrants some independent research, but we’re just going to jump into creating a Wise account, and then spending money in Ghana with as little as possible lost to financial charges.

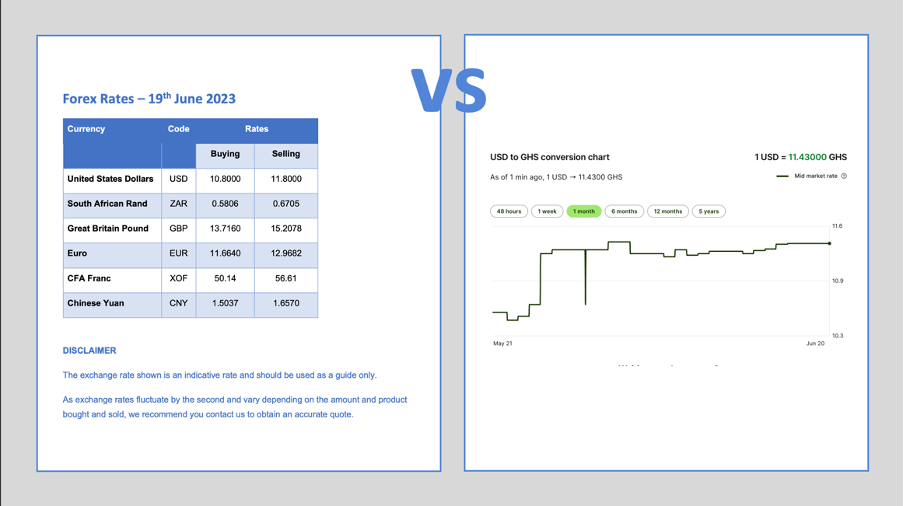

Here's a quick $100 comparison between Wise and local banks acting as providers for VISA and Mastercard in Ghana. It ends up converting to GHS1,080 for the local providers compared to Wise’s GHS1,143.

Sold? Let’s jump into creating a Wise account then. It should be quite straightforward.

Creating Your Account

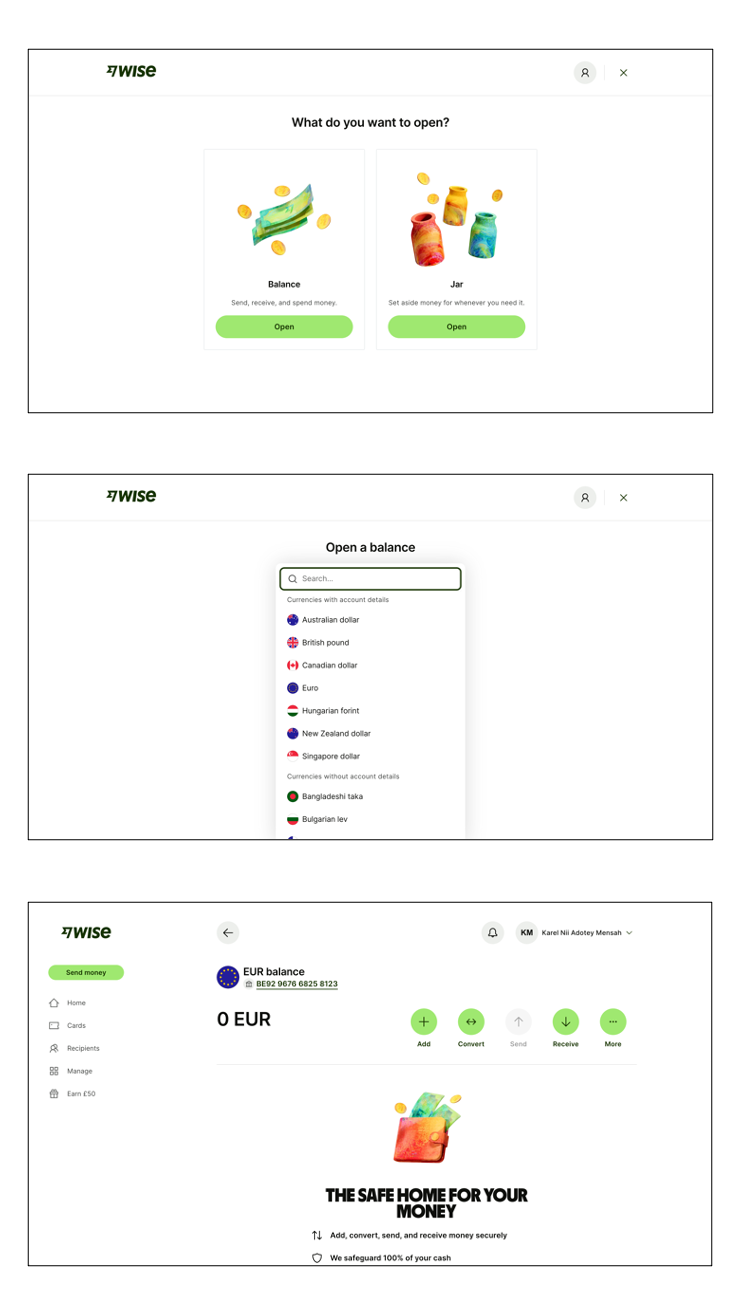

All you need to do to create a Wise account is to visit the website here and register. Once you’ve created an account, you can create a balance in any currency of your choice to save and transfer money into/from.

Adding a Balance

Once you’ve created your Wise account, you’ll need to add a balance. You can create balances in over 50 currencies (limited to one per currency).

You’ll be required to add some money when you’re creating a balance, but after that, you’re free to send and receive in that currency as you wish. You’ll also be able to create a new balance in another currency, and transfer money to that currency.

That’s it for setting up an account and a balance on Wise, next let’s see what it looks like to ‘chop money’ in Ghana.

Transact Like A Local With Mobile Money

Mobile Money has become a way of life in Ghana. Ghana has a sizable uneducated population, and Mobile Money brings the same tech and security you would get from a money transfer app to a simple USSD application that will run on any mobile device. Wise allows you to send money from any currency directly into a Mobile Money account at current exchange rates and at very low transaction costs.

In most cities in Ghana, except for very small transactions, you’ll find different shops and services accepting Mobile Money directly as payment, although you might have to ask for it.

Practically all the telcos in Ghana provide Mobile Money services. When you arrive in Ghana, you should register for Mobile Money when you’re getting your SIM card. All you’ll need as a foreigner to complete your registration is your passport.

Cash in your Mobile Money account is only accessible through a PIN code when it's being sent from your phone or when you’re making a withdrawal. You’ll find multiple kiosks similar to the following image in most communities, and they’re where you can make cash withdrawals from your Mobile Money account. You just need to make sure that you see the sticker for your Mobile Money provider. Some grocery shops and supermarkets also double as Mobile Money agents where you can make withdrawals.

Mobile Money brings many conveniences like the ability to make transactions with low cash on hand or the accessibility of making withdrawals, but if you use a smartphone, the USSD app might be a little slower than you’re used to.

In that case, there are also third-party apps such as ExpressPay that allow you to make Mobile Money transactions even more conveniently from a more friendly interface.